The mathematical tool that displays most clearly a risk management strategy is a probability distribution. A bank will take the money it holds and invest it in various ways. It can hold currency, or loan the money to customers, or buy treasury bonds, or any number of other ways to try to make money. At the simplest level, a bank should put money into whatever has the best return. If a loan returns 8% while a treasury bond returns only 2%, it surely makes better sense to loan out money rather than buying treasury bonds. On the other hand, it happens all too often that borrowers default. The expected 8% return can turn into a 30% loss. Perhaps the greater safety of treasury bonds outweighs the lesser return. Of course, with enough loans, probably most of them will be paid back and only a few will default.

Somehow a bank needs to estimate with a reasonable degree of accuracy the probabilities of the various possible returns of the various possible investments. One source of risk is simple ignorance, the unknown unknowns. A bank needs to hire the experts who can make accurate estimates, avoid investments where such expertise is unavailable, and keep a watchful eye that the experts don't shy away from too many good new ideas or become overconfident about too many bad old ideas.

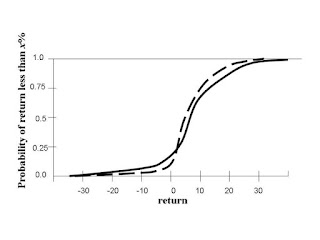

Given an understanding of the probabilities of various outcomes from individual investments, and of correlations among those outcomes, a bank can then evaluate proposed portfolios, can derives the probabilities of outcomes for various combinations of investments. Each potential portfolio will imply a cumulative probability distribution with a shape something like:

Here the greatest likelihood is that of a moderate return. There is a small probability of a loss, and also a small probability of a very high return. This distribution could represent the existing portfolio of a bank. A small shift in the portfolio, moving money into a new type of investment, will change this distribution somehow.The most attractive sort of shift is a pure win:

The dashed line shows the new distribution. If at every possible level of return the probability of making less money decreases and the probability of making more money increases, the decision becomes very easy. The proposed new investment is too good to pass up!Generally, of course, one is faced with more difficult decisions. A typical investment might add some potential for losses, but more likely will bring improved returns:

Another type of investment that often, though not always, make good sense is some kind of insurance. Insurance will reduce the probability of large losses, at the price of smaller returns under other circumstances: A genuine gamble is one that most likely will lose money but for which there is a smaller probability of a large win: Of course, real proposals will often involve complex shifts in the probability distribution, giving them aspects of both increasing and reducing risk:To regulate effectively the risk management practices of financial institutions, one must distinguish between the sorts of risks that can be taken:

- Investments can involve significant unknowable risks, e.g. because of possible political or technological shifts.

- Understanding risks, i.e. accurately estimating the probability of a proposed portfolio, can involve considerable expense that the institution might be unwilling or unable to incur.

- Even when accurate probability distributions are available, it is not clear or simple how to distinguish which distributions represent responsible risk and which constitute violations of the public trust.

Here's an idea I've been thinking about in regards to trying to draw that line between acceptable and unacceptable strategies. Let's try to build a simulation of the market factors that determine the value of the investment. Some simulation models are straightforward some are hard. For example, simulating the potential outcomes of an investment that only depends on a single highly liquid instrument - say a US Government bond - can be done with any number of simple volatility models. Just simulate some form of random distribution and let it evolve over time. Add a second factor, maybe a currency swap that depends on two interest rates and on an FX rate. Each of those is easy to model on its own but now you also have a correlations to worry about. Still, not too bad. What about the probability that a mortgage held by an individual will default? We can look at historical data of other borrowers of similar sized mortgages in the same neighborhood in the same age group etc and get an estimate of the probability, but the individual probability is not a traded market factor at all. It is dependent on all kinds of things that are not predictable. Maybe the borrower gets sick, gets divorced, who knows. That sounds like a less "modelable" factor. Mortgage backed securities got AAA ratings because the theory was that if you have a whole bunch of mortgages to a similar pool of borrowers you will experience something close to the observed historical probability of default. But you also need to consider the correlation between them. This is where the banks messed up in 2007. The correlation factor was way off.

ReplyDeleteSo the goal is to build a good model. As you suggest, you can use Monte Carlo simulation to look at potential future returns. Maybe there is a measure of difficulty - modelability - that we can come up with. Increasing the number of market factors necessary to simulate the market is one indicator. Another might be the number of correlation factors required. Then there is a measure of liquidity to rate how reliable any given market indicator would be in a crisis...

Not sure if it is possible, but it seems to me, some measure of riskiness could be based on a measure of how amenable the instrument is to a model.

Ah, this question of liquidity, that is a whole dimension that I completely missed. What is the value of something - that depends on how quickly you need to sell it!

DeleteThat is a funny paradox, the need to quantify the quantifiability of a thing. But maybe there can be ways of escaping that. I can imagine dividing assets into classes based on likely accuracy of the available models. One could simulate only the most accurate part of a portfolio, then simulate again including the next class of less modelable assets, etc. Along with the series of gradually more inclusive but less accurate probability distributions, one would document the total assets in each class.

Of course, just because you think you have an accurate model, that doesn't mean you really do. Seems to me that the models and the simulations should be audited, so at least there could be some minimally acceptable standards. No way to avoid every disaster, but at least avoid those that *can* be foreseen!